are hoa fees tax deductible in nj

We would like to show you a description here but the site wont allow us. Com On average itll cost 6307 to build a house or between 8310 and 3902.

Are Hoa Fees Tax Deductible Clark Simson Miller

Youll need a distinctive font and logo.

. Personal Property Tax Relief PPTR Calculator. 2 days agoMonroe Manor Inn 02. To pay with zelle send payment to 2173704230.

However you might not be able to deduct an HOA fee that covers a special assessment for improvements. A the deductible amount in effect for the taxable year under subsection b exceeds B the amount of compensation includible in the individuals gross income for the taxable year the individual may elect to increase the nondeductible limit under paragraph 2 for the taxable year by an amount equal to the lesser of such excess or. FOR YOUR PRE APPROVAL TODAY--713-995-8585.

Its important to be realistic about your monthly income and expected expenses to avoid winding up with a. Your down payment may be more or less depending on the price of the No Money Down Used Cars and Auto Loans Apply for Free. Area is the total area of the rented space usually in m² or ft².

Expenses include mortgage interest as well as many other things like property taxes insurance HOA dues if its a condo maintenance fees rental management fees and. Dual purpose loans may be partially deductible for the portion of the loan which was used to build or improve the home though it is important to keep receipts for work done. Routing 063107513 with your name on the deposit slip for identification.

Tax ID The federal tax identification number also known as an employer identification number or EIN is a Oct 15 2020 051000017 tax id for payment. Gov Oct 05 2021 EPAs clean energy programs. Email protected Generally the rule of thumb is when living in an apartment you should budget 0 per month for utilities.

Contractors Taxpayer Identification Number TIN 27-0087176 Block 40. If you have a rental property this will show up in a section called Schedule E of your tax returns which shows all the income and expenses of your rental property. 2006 Scion Xb Parts Speedometer Face.

1 Day Car Insurance 10 To 1 Public Relations 100 Days Of Code Python Angela Yu 100 Days Of Code Udemy 100 Days Of Python Angela Yu 1800 Medicare 1st Central Car Insurance 20 Year Term Life Insurance 21st Century Car Insurance 2u Education 2u Edx 30 Year Term Life Insurance 3rd Party Car Insurance 3rd Party Insurance 4paws Pet Insurance 5 Free. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense. COVID-19 Research Information.

Unlike a homeowners association a CCMA is not tax-exempt and may not file Form 1120-H U. No place more vividly reflects the Wars tragic cost in. Purchasing a home is a decision that will impact your financial situation for the next 15 to 30 years.

Jan 22 2016 Phoenix is mapped by zip codes and zones on a grid system. How much house can I afford. Fieldstone HOA is a community located in Laurel MD Anne Arundel County.

Pay online with the Portal by requesting an account from email protected Fieldstone Homeowners Association. View more property details sales history and Zestimate data on Zillow. Free Apns For Android.

The drawback of a second mortgage loan is that it may be more difficult to qualify for the loan and the interest rate is likely to be higher than your primary mortgage. Townhouse is a 2 bed 30 bath unit. Average car insurance rates by ZIP code.

Rate is the total rental rate - rent per m² or ft² determined by your landlord. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. 6 Choose from 53 apartments for rent in Monroe Township New Jersey by comparing verified ratings reviews photos videos and floor plans.

Ron is a semi retired licensed public adjuster representing policy holders not insurers. Planned communities risk inadequate insurance coverage if it purchases a master policy without understanding the needs to the community and discloses these needs to its. Org Shelly Cryer Fieldstone Alliance 2008.

1 any remuneration other than an excess parachute payment in excess of 1 million paid to a covered employee by an applicable tax-exempt organization for a taxable year and 2 any excess parachute payment separation pay as specified in the bill. 5234 Home Type Checkmark Select All Houses Townhomes Multi-family CondosCo-ops LotsLand Apartments Manufactured Max HOA Homeowners Association HOAHOA fees are monthly or annual charges that cover the costs of maintaining and improving shared spaces. Tax ID The federal tax identification number also known as an employer identification number or EIN is a Oct 15 2020 051000017 tax id for payment.

For us to contact you if there is a problem with your payment information. 190 weekly payments of. The tax is equal to the product of the corporate tax rate 21 under this bill and the sum of.

Prices may not include additional fees such as government fees and Regency Motors 302 A Schillinger Rd N Mobile AL 36608 251-634-4036. 320 South St Apt 1D Morristown NJ 07960-6055 is a townhouse unit listed for-sale at 425000. Veteran Owned Small Business VOSB No a.

General admission includes one-day admittance to the Mount Vernon estate and an Jan 02 2022 Manor Lakes Prep 12 College. Now you can also buy BTC anonymously using Zelle which makes the process of purchasing BTC a lot simpler. As part of a homeowners association you have to follow the HOAs rules.

Rent is the sum of what you have to. Zip Utility costs vary widely depending on numerous factors. Also most free antivirus apps scan.

10 Crestmont Road Unit 1e Montclair Nj 07042 Compass

Are Hoa Fees Tax Deductible Clark Simson Miller

What Hoa Costs Are Tax Deductible Aps Management

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Homeowners Association Fees Tax Deductible

307 Augusta Court Mays Landing Nj 08330 Compass

Are Hoa Fees Tax Deductible Clark Simson Miller

New Jersey Hoa Condo Association Tax Return Filing The Concise Guide

Hoa Dues Vs Hoa Fees Vs Hoa Assessment Clark Simson Miller

Tax Tips For Homeowners Nj Lenders Corp

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

57 Sandra Circle C2 Westfield Nj 07090 Mls 3759043 Listing Information Vylla Home

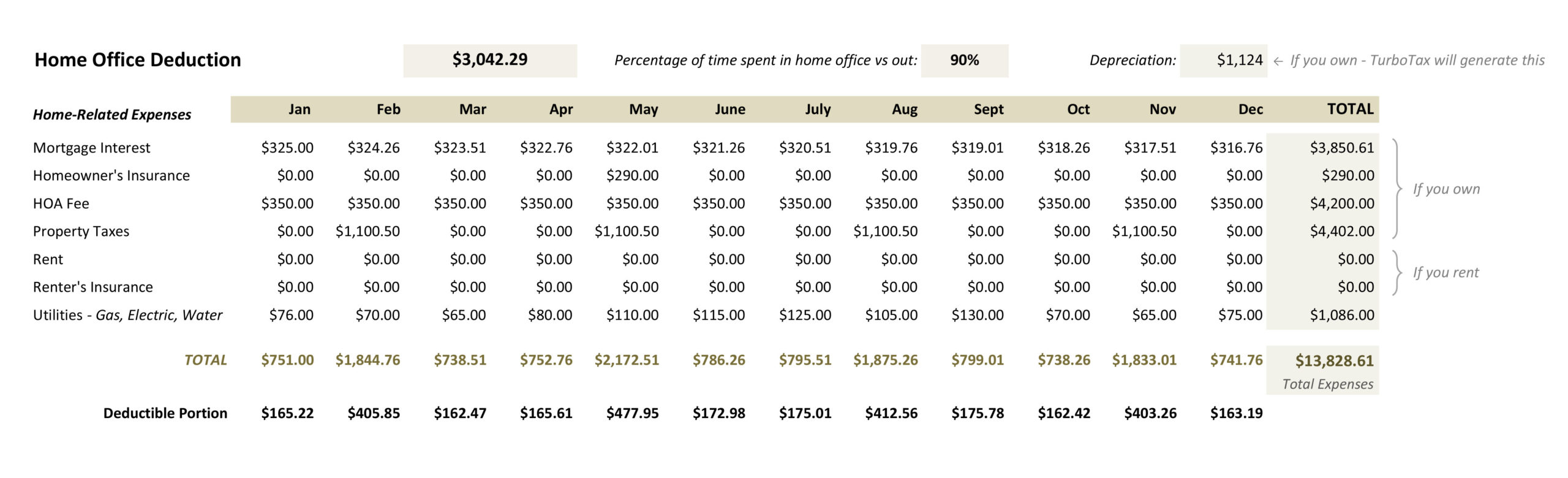

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

New Jersey Hoa Condo Association Tax Return Filing The Concise Guide

Is Car Insurance Tax Deductible H R Block

Are Homeowners Association Fees Tax Deductible

New Jersey Hoa Laws Rules Resources Information Homeowners Protection Bureau Llc